Coronavirus Market Impact: Water & Wastewater Industry

Bob Crossen is senior managing editor for WWD. Crossen can be reached at [email protected].

COVID-19 swept across the globe in late 2019 and early 2020, resulting in events cancellations, business closures, and project delays, among other business impacts. To better understand the impact of this virus on the water and wastewater treatment industry, Water & Wastes Digest conducted a market impact survey to determine the extent to which businesses and utilities are affected. Below are demographics of the survey respondents, charts of the responses submitted in the survey, and some industry comments on subjects related to the findings.

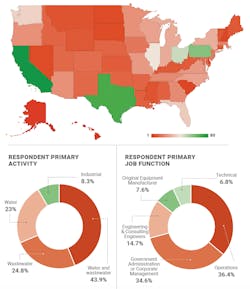

Respondent Location

The survey garnered 913 responses from across the globe. 881 of those who responded live in the U.S., while 12 are from Canada and six are from South America. The remaining respondents were from European and Asian countries, and even from Australia.

Respondent Job Function

Of the 913 surveyed, 332 indicated their primary job function was Operations, 316 said Government Administration & Corporate Management, 134 indicated Engineering, 62 said their primary job function was technical and 69 said they were Original Equipment Manufacturers (OEM). To access a report in which these survey results are broken down by job function, visit bit.ly/wwdcovidreport.

Respondent Primary Activity

401 respondents indicated their primary activity included both water and wastewater functions. 210 indicated water-only and 236 claimed wastewater only. The remaining 76 respondents marked industrial systems. A report breaking down these results from only industrial users is available

at bit.ly/iwwdcovidreport.

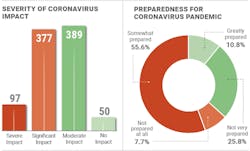

Market Impact Severity

In looking at the responses to the survey results, what first comes to mind is a sense of uncertainty. When indicating the severity the coronavirus would have on the industry, respondents were pretty evenly split between Sizeable Impact and Moderate Impact. This suggests that most respondents are somewhere in the middle of whether they consider it leaning severe or leaning less severe. This result must also take into account the time during which the survey was conducted from March 19 to April 6, during the early stages of social distancing and self-isolating.

Fran Cain, assistant director of public works for Westfield, Massachusetts, said the virus has caused some disruptions for his utility, but nothing of grave magnitude or concern.

“It’s definitely impacted us in our day-to-day operations, but it’s certainly not anything we haven’t been able to handle yet,” Cain, a WWD editorial advisory board member, said. “We also haven’t had any staff that have been incapacitated with it yet, so that’s a worry. We’ve taken some decent measures to prevent that, cross contamination and such, but I think time will tell.”

Doug Riseden, technical support manager for HYMAX, a Mueller brand, said that despite policy changes for social isolation and cancellations of events and conferences, many things are still the same.

“There’s been some drastic changes, and yet in some areas of our business, it’s business as usual because it needs to be,” Riseden, WWD 2019 Industry Icon, said, “but I do believe we’ll see some notable changes as we progress through this and some of those changes may become commonplace when this comes to an end.”

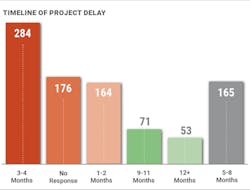

Project Delays or Cancellations?

Overwhelmingly respondents said that projects would be delayed due to the coronavirus outbreak. Only around 4% said projects would be canceled entirely, and the remainder indicated that projects would continue as normal. Steve Gilbreath, vice president and business group director of water conveyance for Lockwood, Andrews & Newnam, said a stimulus package with water or wastewater funding allocated in it would make a difference in project timelines.

“A lot of times with stimulus packages like this is there are shovel-ready projects,” Gilbreath said. “So there may be a push to have projects really ready to go if that is part of what the stimulus package criteria is going to be. In our industry, we can see design continuing in getting ready and in anticipation of shovel-ready projects.”

Gilbreath also said that in reaching out to vendors and solutions providers, there was optimism in sales and providing solutions for projects. The main culprit of worry was the health and wellbeing of employees manufacturing products and shipping them to the end user.

Watch the Coronavirus Market Impact Webinar

WWD shared the findings of the survey in a webinar April 9, which is available on demand. Visit bit.ly/wwdcovidwebinar to watch it on-demand for expert panelist insights and perspectives.