2016 State of the Industry

Water and wastewater professionals are feeling on the upswing going into 2017, according to W&WD’s 2016 State of the Industry report.

The survey covers market dynamics, including professional and business demographics, budget and purchasing involvement and expenditures, and importance of industry issues.

Research for this report was conducted by ABR Research Inc., an independent research company specializing in custom research for clients in the business-to-business publishing and marketing industries.

The survey was conducted entirely over the Internet. The margin of error based on the returned surveys is calculated to be no greater than +/- 6.1 percentage points at a confidence level of 95%.

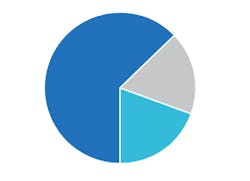

While 2015 saw 32% of respondents’ revenues increase, 2016 yielded 34% of respondents with the same good fortune. The portion of respondents who claimed a revenue decrease between 2015 and 2016 is down to just 13% of respondents versus last year’s 19%.

There is more confidence in next year panning out to be a good year than was noted in last year’s survey: In 2015, 13% of respondents thought their revenue would decrease in 2016; but in this year’s survey, just less than 5% of respondents predicted a revenue decrease in 2017.

Similarly, the number of respondents reporting good or very good overall firm health rose between 2015 and 2016, with 75% of respondents claiming good to very good overall firm health, compared with 69% who claimed the same in 2015.

Twenty-six percent of respondents are planning construction of new water or wastewater facilities within the next 24 months. An additional 8% have new construction plans within 36 months. Forty-one percent are planning to upgrade their facilities. This number is down from last year’s 55%.

The largest percentage of respondents’ budgets will be invested in pipe and distribution over the next 24 months. This will account for 16% of budget expenditure. Sewer and collection and pumping equipment are the next highest expenditures, with 12% of budget allocated for each over the next 24 months.

More than two-thirds (69%) of survey respondents are involved with determining needs, 48% evaluate brands, 59% specify products and vendors, and 43% have authorizing and approval responsibility. Overall, 84% of respondents are involved in the buying process.

Download: Here